Three ways to position your portfolio in times of uncertainty.

Developments over recent months have proved a wake-up call to markets after a complacent start to the year.

Amid this heightened uncertainty, investors may wish to favour a more defensive stance in their portfolios. To this end, we have set out below some ideas for consideration.

Look at short-term bonds as way to address portfolio risk.

Market development over the recent months have been marked by high volatility. Short-term bonds may help lower portfolio risk while the positive yield they provide means they have scope to outperform cash.

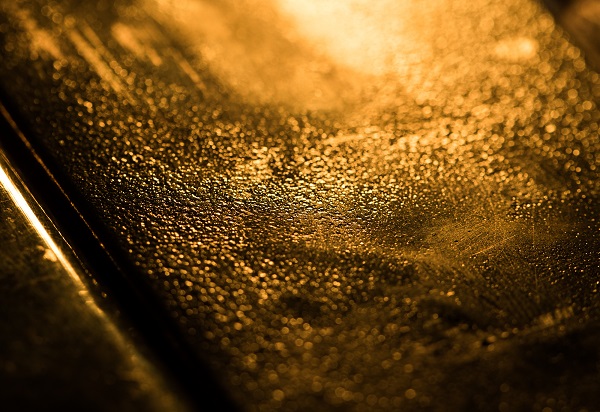

Consider adding diversification and protection with gold.

Gold has long been lauded as a potential hedge against uncertainty and, in the toughest of times, has provided a welcome diversification benefit that few assets can match.

Think about using longer-dated treasuries to mitigate US recession risks.

Exploring US government bonds may be a way to provide some stability to portfolios at a time of tightening financial conditions in the markets and lending standards in the economy.

KNOWING YOUR RISK

It is important for potential investors to evaluate the risks described below and in the fund’s Key Information Document (‘KID’) or Key Investor Information Document (“KIID”) for UK investors and prospectus available on our websites www.amundietf.com.

CAPITAL AT RISK - ETFs are tracking instruments. Their risk profile is similar to a direct investment in the underlying index. Investors’ capital is fully at risk and investors may not get back the amount originally invested.

UNDERLYING RISK - The underlying index of an ETF may be complex and volatile. For example, ETFs exposed to Emerging Markets carry a greater risk of potential loss than investment in Developed Markets as they are exposed to a wide range of unpredictable Emerging Market risks.

REPLICATION RISK - The fund’s objectives might not be reached due to unexpected events on the underlying markets which will impact the index calculation and the efficient fund replication.

COUNTERPARTY RISK - Investors are exposed to risks resulting from the use of an OTC swap (over-the-counter) or securities lending with the respective counterparty(-ies). Counterparty(-ies) are credit institution(s) whose name(s) can be found on the fund’s website amundietf.com. In line with the UCITS guidelines, the exposure to the counterparty cannot exceed 10% of the total assets of the fund.

CURRENCY RISK – An ETF may be exposed to currency risk if the ETF is denominated in a currency different to that of the underlying index securities it is tracking. This means that exchange rate fluctuations could have a negative or positive effect on returns.

LIQUIDITY RISK – There is a risk associated with the markets to which the ETF is exposed. The price and the value of investments are linked to the liquidity risk of the underlying index components. Investments can go up or down. In addition, on the secondary market liquidity is provided by registered market makers on the respective stock exchange where the ETF is listed. On exchange, liquidity may be limited as a result of a suspension in the underlying market represented by the underlying index tracked by the ETF; a failure in the systems of one of the relevant stock exchanges, or other market-maker systems; or an abnormal trading situation or event.

VOLATILITY RISK – The ETF is exposed to changes in the volatility patterns of the underlying index relevant markets. The ETF value can change rapidly and unpredictably, and potentially move in a large magnitude, up or down.

CONCENTRATION RISK – Thematic ETFs select stocks or bonds for their portfolio from the original benchmark index. Where selection rules are extensive, it can lead to a more concentrated portfolio where risk is spread over fewer stocks than the original benchmark.

IMPORTANT INFORMATION

This information is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities or services in the United States or in any of its territories or possessions subject to its jurisdiction to or for the benefit of any U.S. Person as this term is defined in SEC Regulation S under the U.S. Securities Act of 1933. The US person definition is indicated in the legal mentions section on www.amundi.com, or www.amundietf.com. This is a promotional and non-contractual information which should not be regarded as an investment advice or an investment recommendation, a solicitation of an investment, an offer or a purchase, from Amundi Asset Management (“Amundi”) nor any of her subsidiaries. Investment in a fund carries a substantial degree of risk (i.e. risks are detailed in the KID or the KIID for UK investors and prospectus). Past Performance does not predict future returns. Investment return and the principal value of an investment in funds or other investment product may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability. Transaction cost and commissions may occur when trading ETFs. It is the investor’s responsibility to make sure his/her investment is in compliance with the applicable laws she/he depends on, and to check if this investment is matching his/her investment objective with his/her patrimonial situation (including tax aspects). A summary of information about investors’ rights and collective redress mechanisms can be found in English on the regulatory page at https://about.amundi.com/Metanav-Footer/Footer/Quick-Links/ Legal-documentation with respect to Amundi ETFs. This document was not reviewed, stamped or approved by any financial authority. This material is based on sources that Amundi and/or any of her subsidiaries consider to be reliable at the time of publication. Data, opinions and analysis may be changed without notice. Amundi and/or any of her subsidiaries accept no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material. Amundi and/or any of her subsidiaries can in no way be held responsible for any decision or investment made on the basis of information contained in this material. Units of a specific UCITS ETF managed by an asset manager and purchased on the secondary market cannot usually be sold directly back to the asset manager itself. Investors must buy and sell units on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units and may receive less than the current net asset value when selling them. Potential investors in the UK should be aware that none of the protections afforded by the UK regulatory system will apply to an investment in a Fund and that compensation will not be available under the UK Financial Services Compensation Scheme.

Information reputed exact as of 30 June 2022. Reproduction prohibited without the written consent of the Management Company.

Amundi ETF designates the ETF business of Amundi Asset Management.

Amundi Asset Management, French “Société par Actions Simplifiée” - SAS with capital of 1 143 615 555 €

- Portfolio Management Company approved by the AMF under number GP 04000036

- Registered office: 91, boulevard Pasteur - 75015 Paris – France - 437 574 452 RCS Paris